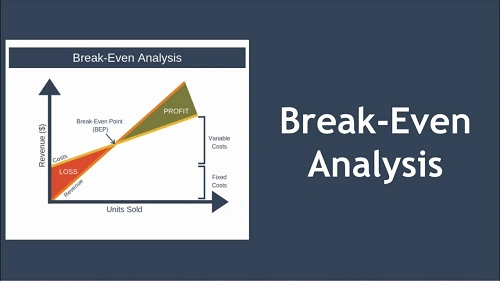

Before thinking about profit, a firm must first recover its costs. Break-even analysis helps answer this fundamental question in a clear and structured way.

Break-even analysis is widely used in cost accounting, budgeting, and financial planning. It shows the point at which total revenue equals total cost where there is no profit and no loss. While it is a powerful planning tool, it also has certain limitations that must be understood.

What Is Break-Even Analysis?

Break-even analysis is a financial technique used to determine the level of sales at which a business covers all its fixed and variable costs.

At the break-even point:

- Total cost = Total revenue

- Profit = 0

- Loss = 0

It helps management understand the relationship between cost, volume, and profit.

Advantages of Break-Even Analysis

1. Simple and Easy to Understand

One of the biggest advantages of break-even analysis is simplicity.

It:

- Uses basic cost and sales data

- Is easy to calculate and interpret

Even non-financial managers can understand it easily.

2. Helps in Profit Planning

Break-even analysis shows how much sales are needed to earn a desired profit.

Management can:

- Set sales targets

- Plan production levels

- Estimate profit at different sales volumes

This supports effective planning.

3. Useful for Cost Control

The analysis highlights cost structure.

It helps management:

- Identify fixed and variable costs

- Control unnecessary expenses

Understanding cost behavior improves cost management.

4. Assists in Pricing Decisions

Break-even analysis helps in fixing selling prices.

Management can:

- Analyze impact of price changes

- Decide minimum price to avoid loss

This is useful in competitive markets.

5. Supports Decision-Making

Break-even analysis assists in many business decisions.

It is useful for:

- Introducing a new product

- Expanding operations

- Choosing between alternatives

It provides a logical basis for decisions.

6. Shows Margin of Safety

Break-even analysis indicates the margin of safety.

This shows:

- How much sales can fall before losses begin

A higher margin of safety means lower business risk.

7. Useful for Startups and New Projects

For new businesses, break-even analysis is very helpful.

It helps:

- Assess feasibility

- Estimate time to reach no-loss stage

- Plan funding requirements

This reduces uncertainty in early stages.

Disadvantages of Break-Even Analysis

Despite its usefulness, break-even analysis has limitations.

1. Assumes Constant Costs and Prices

Break-even analysis assumes:

- Fixed costs remain constant

- Variable cost per unit is unchanged

- Selling price stays the same

In reality, costs and prices often change.

2. Ignores Demand and Market Conditions

The analysis focuses on cost and volume only.

It does not consider:

- Customer demand

- Competition

- Market trends

Reaching break-even sales may not always be practical.

3. Assumes All Output Is Sold

Break-even analysis assumes that:

- Whatever is produced is sold

This ignores inventory build-up and unsold stock.

4. Not Suitable for Multi-Product Firms

Break-even analysis becomes complex when:

- Multiple products are involved

- Sales mix keeps changing

Results may be misleading if product mix shifts.

5. Oversimplifies Business Reality

The analysis simplifies a complex business environment.

It ignores:

- Efficiency changes

- Learning curve effects

- Technological improvements

This reduces accuracy.

6. Short-Term Focus

Break-even analysis is more useful in the short run.

In the long run:

- Fixed costs may change

- Capacity may expand

This limits long-term applicability.

7. No Consideration of Time Value of Money

Break-even analysis does not consider:

- Timing of cash flows

- Time value of money

This can affect investment decisions.

When Break-Even Analysis Works Best

Break-even analysis is most effective when:

- Cost behavior is stable

- Business deals in a single product

- Used for short-term planning

- Combined with other financial tools

It should guide planning, not replace judgment.

Final Thoughts

Break-even analysis is a practical and powerful planning tool. It helps businesses understand cost structures, set sales targets, and evaluate risk. For startups and managers, it provides clarity on the minimum performance required to survive.

However, break-even analysis is not a complete decision-making tool. Its assumptions about costs, prices, and sales often differ from real-world conditions. Used alone, it can lead to overconfidence or wrong conclusions.

The real value of break-even analysis lies in awareness. When used alongside market analysis, budgeting, and managerial experience, it becomes a useful guide for smarter and more realistic business decisions.