Your email ID linked to GST is not just a communication tool—it is your gateway to filing returns, receiving notices, OTP verifications, and getting important updates from the GST department. So, what happens if you change your email, lose access to the old one, or simply entered the wrong one during GST registration?

Don’t worry changing your email ID on the GST portal is simple, free of cost, and can be done online. Whether you’re a business owner, trader, or professional, keeping your contact details updated ensures that you don’t miss any important GST compliance messages or filing deadlines.

Let’s understand how you can easily update your email address in the GST portal.

Who Can Update the Email ID?

Only an Authorized Signatory or a Promoter/Partner listed in your GST registration can make changes to your email ID or mobile number. This ensures that only verified people can access and update sensitive contact details.

Steps to Change Email ID on GST Portal

Follow these easy steps:

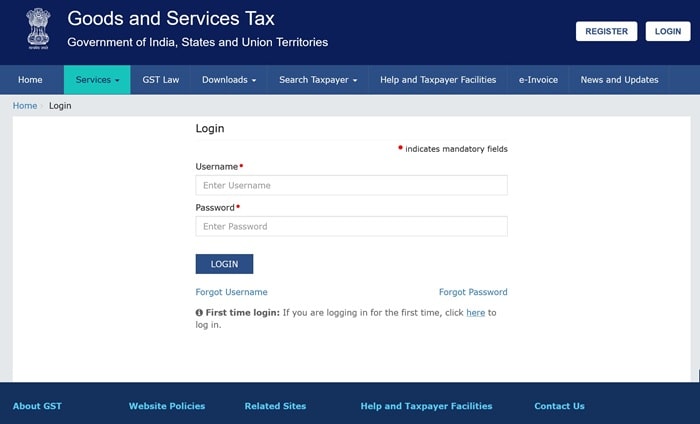

Step 1: Visit the GST Portal – The official GST website – www.gst.gov.in

Step 2: Login to Your Account – Use your GSTIN, username, and password to log in.

Step 3: Navigate to Services > Registration > Amendment of Core Fields – This option allows you to edit core details like contact information.

Step 4: Select the Authorized Signatory/Promoter Tab – Click on the section showing your name (or the person whose contact details need to be updated).

Step 5: Click ‘Edit’ and Enter New Email ID – You can now replace the old email ID with the new one. Do the same for the mobile number if needed.

Step 6: Verify Using OTPs – GST portal will send OTPs to the new email ID and new mobile number. Enter both OTPs to confirm the update.

Step 7: Submit the Application – Use Digital Signature Certificate (DSC) or EVC (Electronic Verification Code) to submit the form securely.

Step 8: Track Status Using ARN – After submission, an Application Reference Number (ARN) will be generated. You can track your request using this ARN on the portal.

How Long Does It Take?

In most cases, the GST department processes the request in 2 to 5 working days. Sometimes, it may take longer if verification is required or system delays occur.

Important Notes

- You don’t need OTP from your old email or mobile number.

- Make sure all pending GST returns are filed before updating contact details.

- If the update fails, check if your GST registration is active and there are no legal issues.

Frequently Asked Questions (FAQs)

1. Can I change my email ID without access to the old email?

Yes, you can update your GST email ID even if you don’t have access to your old one. Only new email OTP is required for verification.

2. Is there any charge to change the email ID in GST?

The GST portal does not charge any fee. However, if you take help from a consultant, they may charge ₹200–₹500 for the service.

3. Can my accountant or GST consultant change the email on my behalf?

Only if they are listed as an Authorized Signatory on your GST registration. Otherwise, the business owner must do it.

4. How many times can I update my email or phone number in GST?

There is no official limit, but frequent changes may trigger verification from the GST department.

5. Why is my new email ID not reflecting after submission?

There may be a processing delay, or your application might be under verification. Check the ARN status or contact the GST helpdesk for assistance.

Conclusion

Keeping your GST email ID up to date is essential for smooth and secure tax compliance. Whether you’re a small business, startup, or freelancer, updating your details helps avoid missed deadlines, failed OTPs, and lost communication. With the step-by-step method above, you can easily change your email on the GST portal—yourself or with professional help.